Are your growing receivables tightening your cash flow or limiting expansion?

Turn your unpaid

invoices into CASH!

Leverage our 25+ years experience to match you with the BEST factor for your needs.

Rates APPROXIMATELY 2% per month.

Our job is to find you the best deal and relationship.

No hidden fees.

What is "Factoring"?

"Factoring" (or "Invoice Factoring") is a financial transaction where a business SELLS its accounts receivables, or invoices, to a third party known as a "factor" at a discount. The factor then takes on the responsibility of collecting payments from the business's customers.

This process allows businesses to receive immediate cash flow rather than waiting for the payment terms of the invoices, which can range from 30 to 90 days, or more.

The term "factor" originates from the Latin word "facere," which means "to make" or "to do".

It originates from ancient trade practices, where merchants sold their trade debts to intermediaries called, “factors” for immediate funds.

Why Factoring?

At one time or another, every company runs into a cash flow crunch, losing out on business opportunities or falling behind while waiting 30, 60, 90 or even 120 days for customer payments.

Unfortunately, traditional financing doesn’t always fit these needs, has too many restrictions or takes too long for approval.

Once you're set up, you can get funds the same day an invoice is submitted!

Who Are We?

FactorMatch is a business capital matchmaker that specializes in the Invoice Factoring, Purchase Order Financing and the Asset-Based Lending space.

We help businesses in the USA, Canada and Europe, with funding up to $3M per month (or more). Our team has over 25 years of experience providing business capital to start ups and on-going enterprises.

We start by understanding your needs and then custom tailoring the right relationship, while educating you along the way.

We're able to find you the best match, by leveraging our extensive long-term relationships.

Our ability to provide funding where others have failed sets us apart. Whether you are a start up without a credit history or an established business that needs predictable funding not provided by traditional banks, we can help!

Services

Factoring (Accounts Receivable Financing)

A form of financing in which a company sells its invoices to a (3rd party) factoring company at a small discount, in exchange for immediate cash. It’s used a way to improve cash flow and revenue stability. One of the unique things about Factoring, is it is primarily based on the credit of your client – and not your business.

Invoice Financing

A form of financing that functions as a cash advance on outstanding customer invoices. You sell us your invoices and we immediately advance you the funds to operate and grow your business. It’s a line of credit based on your sales, not your net worth. It allows business owners to use invoices as a form of collateral to secure a loan or a line of credit. There are no limits, and you can get started with as little as $250,000 in qualified receivables.

Purchase Order Financing

A form of financing that allows you to borrow against your orders, for immediate cash.

Asset-Based Lending

A form of financing that leverages your business assets (ie: inventory, heavy equipment, office supplies, etc) for immediate cash.

Testimonials

E.I.

CEO, Crateris Group (Staffing Company)

★ ★ ★ ★

"Thanks to David and his partners, we were able to find the funding that truly helped our business and made it much easier for us to focus on our business to keep our company expanding!

David is very professional when it comes to providing prompt information and tailor-made solutions!"

G.G.

Owner, GC Management Group

★ ★ ★ ★

"You are so awesome David!!!! That was fast and so smooth!"

P.O.

President, Massachusetts HVAC Company

★ ★ ★ ★

"Meeting weekly payroll was a challenge for many years. I spent many of those years trying in vain to get a bank line that would meet my

needs. Even though I had a great business track record, the banks always provided less than I needed.

When I finally met Eric and his team, not only did they provide funds in the agreed upon time line, they are also the first ones to provide adequate capital to meet my monthly needs."

D.B.

CEO, (Fulfillment Company)

★ ★ ★ ★

"My fulfillment company easily grew by 35% once I started factoring with Eric and his team. Instead of waiting 60 days to be paid, I was

getting funds within one day and this was a game changer for my business."

Who can benefit from Invoice Factoring?

Staffing

Manufacturing

Wholesale

Trucking & Transportation

construction

Technology

Home Services (HVAC, roofing, landscaping, etc)

Urgent care, ChiropractorS, Dentists that have medical insurance claims

Oil & gas

Any b2B with an invoice

FAQ'S

What is "Invoice Factoring"?

"Factoring" (or "Invoice Factoring") is a financial transaction where a business SELLS its accounts receivables, or invoices, to a third party known as a "factor" at a discount.

It is often also commonly known as, "Accounts Receivable Based Financing".

The "Factor" then takes on the responsibility of collecting payments from the business's customers.

This process allows businesses to receive immediate cash flow rather than waiting for the payment terms of the invoices, which can range from 30 to 90 days, or more.

The term "factor" originates from the Latin word "facere," which means "to make" or "to do".

It originates from ancient trade practices, where merchants sold their trade debts to intermediaries called, “factors” for immediate funds.

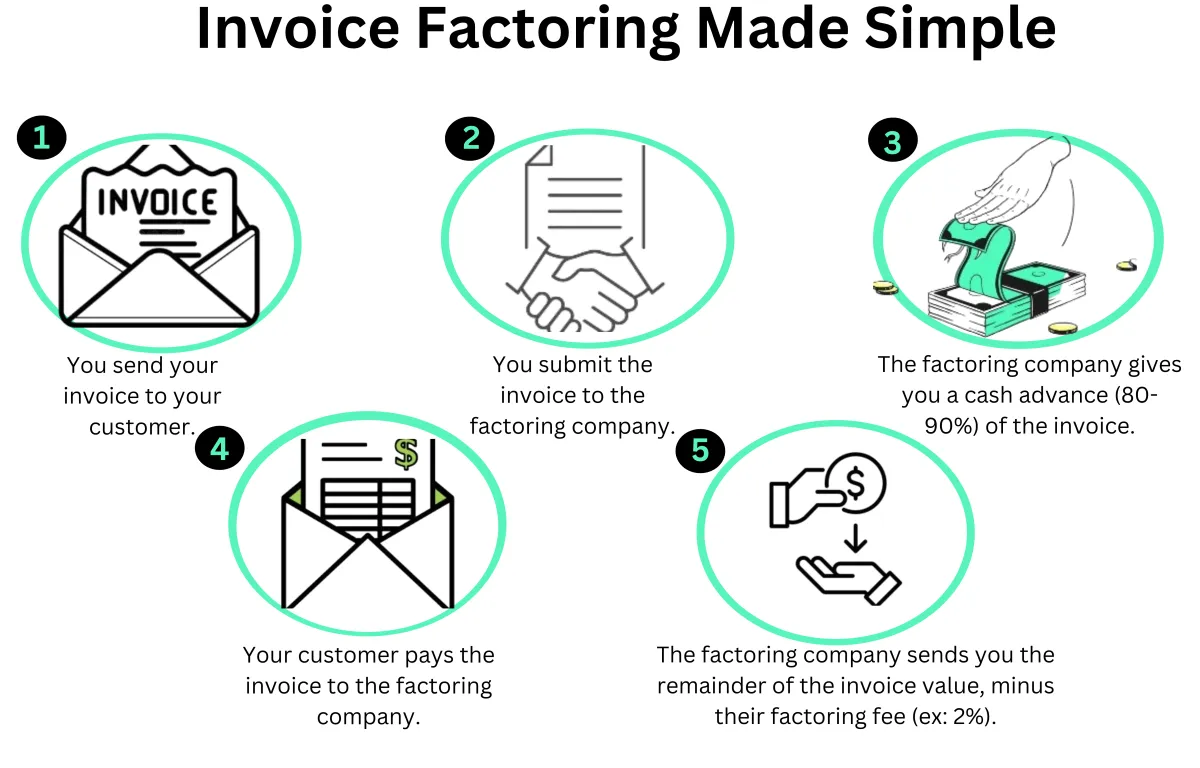

How does Invoice Factoring work?

1. A business performs a service or sells goods to a customer.

2. The business sends the invoice to a factoring company.

3. The factoring company provides a cash advance (typically 80-90%) on the invoice, usually within 24 hours.

4. The factor collects full payment from the customer.

5. The factor pays the business the remaining invoice amount, minus a fee.

What is the rate?

Rates can vary based on various factors like your industry and invoice amounts. Most factoring companies charge between 1% to 4% of the invoice value per month. The ballpark is 2% per month. At FactorMatch, we'll help you get the lowest rate.

What are the benefits?

There are so many benefits:

- Improved cash flow.

- Faster access to funds.

- Easier qualification (since it focuses on invoice value and your customers credit, as opposed to your business & personal credit).

- Enables you to take on new clients and larger contracts.

- Reduces your administrative burden and costs of your accounts receivable/collections staff and more.

- And more.

What businesses can benefit from Invoice Factoring?

Any business that do B2B (Business to Business) and get paid on NET Terms of 30-120 days.

Common examples are:

- Staffing

- Manufacturing

- Construction (and Sub Contractors)

- Wholesale

- Trucking & Transportation

- Technology

- Trade/Home Services businesses who do jobs for businesses (ie: HVAC, Roofing, Landscaping, etc)

FactorMatch also specializes in Urgent Cares, Chiropractors and Dentists that have Medical Insurance Claims.

Why should I use FactorMatch?

Believe it or not, factors specialize in different industries and niche’s. Some have minimums. Some have limits. Some are more conservative and others are willing to take greater risks.

With over 25 years of experience, we have relationships with dozens of factoring companies, allowing us to shop around for the best rates and terms for your specific situation.

We also help explain the process to you, help you prepare everything and make you look as good as possible to the factor.

Finally, we stay by your side as you grow and even potentially recommend moving you to a different factor as you grow and/or your needs change.

What if I have bad credit?

That's one of the many benefits of invoice factoring. It primarily focuses on your invoice value and your customers credit, as opposed to your business & personal credit.

Will it make me look like my business is financially unstable?

No. Factoring is widely used in many industries, especially those with longer payment cycles. It's a standard practice in sectors like manufacturing, wholesale, and professional services.

Though some business owners worry that using factoring might make them look financially unstable, that is an outdated perception. In today's business world, factoring is seen as a smart financial strategy used by companies of all sizes.

Just like a business line of credit or a short-term loan, factoring is simply another financial tool in your arsenal. Many successful businesses use it as part of their overall financial strategy.

Is the factor like a collections company?

A factoring company is NOT a collections agency. Think of them more as a financial partner who works alongside your business.

In many ways, a factor acts like an extension of your own accounts receivable department. They handle the administrative tasks of invoice management, freeing up your time to focus on growing your business.

Our factoring companies prioritize maintaining positive relationships with your clients. They integrate smoothly with your existing processes, causing minimal disruption to your operations or customer interactions.

Get In Touch

© 2025 FactorMatch™. All rights reserved.

FactorMatch™ is a DBA of Arrow On, Inc, a Colorado Corporation.